Table of Content

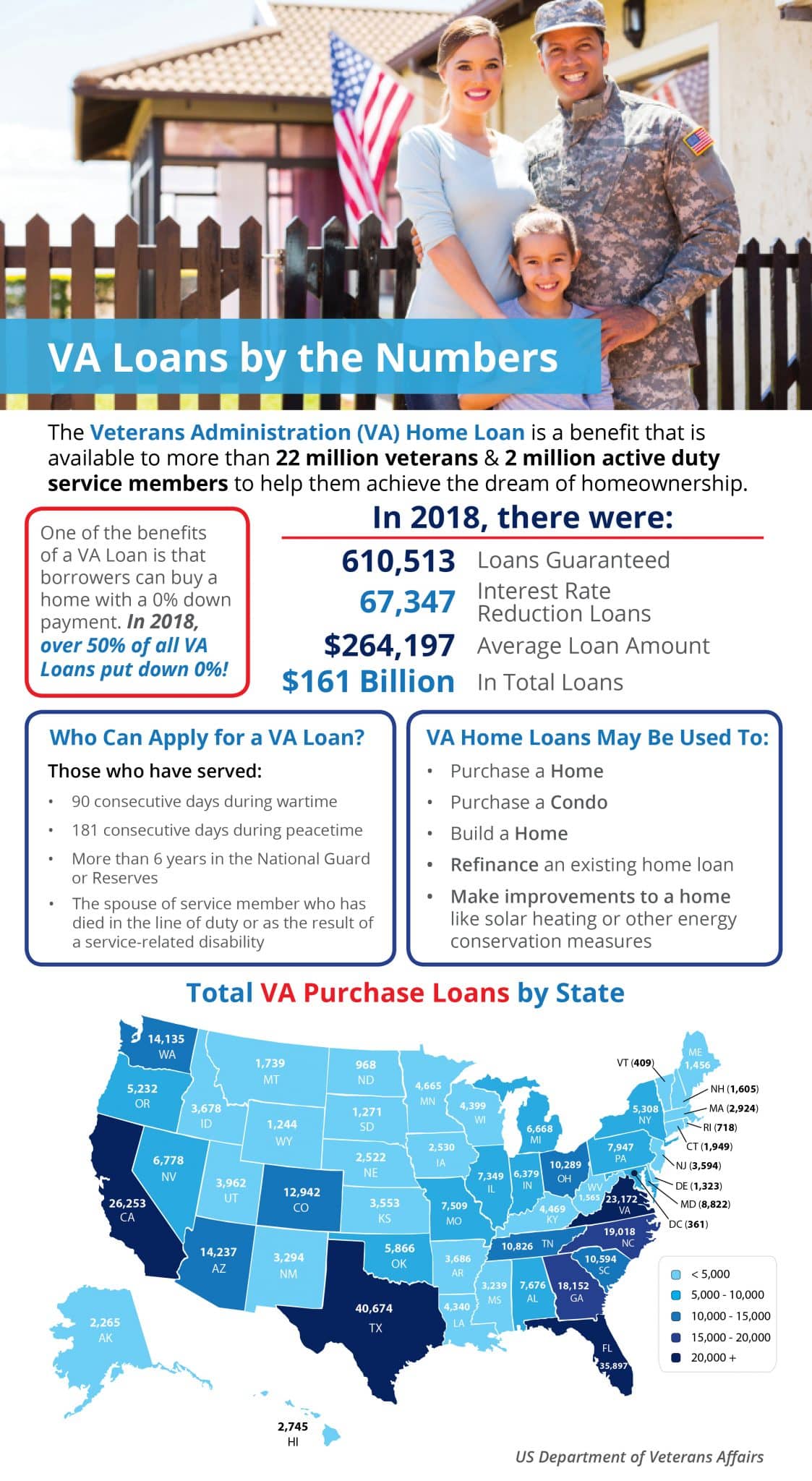

Appraisal waivers aren’t permitted for VA loans as they are for conventional mortgages. With the exception of Fannie Mae’s HomeReady® and Freddie Mac’s Home Possible® , most conventional loans don’t have income limits. In addition to personal funds, borrowers can use various other sources to meet their required 3% down payment. Among these are gifts from related persons, funds from a governmental or non-governmental agency, employer-assisted homeownership programs, and Affordable Seconds. There are no income limits in low-income census tracts. In other census tracts, eligible borrowers will earn no more than 100% of the area median income .

Homebuyers will have more conventional mortgage borrowing power in 2023, with conforming loan limits increasing to $726,200 for a single-family home in most parts of the country. More homebuyers may have a shot at conventional loans with new changes to how lenders calculate qualifying credit scores. Plus, borrowers looking for cheaper housing options can now finance a single-wide mobile home with a conventional loan. Some mortgage programs have income limits, meaning your income cannot exceed a certain percentage of the area’s median income to qualify.

First-Time Home Buyers

To better determine if you qualify, use the Home Possible income and property eligibility tool. “Home Possible is available to anyone who makes less than 80% of the average monthly income for the ZIP code they will be buying in,” Ralph DiBugnara, founder of Home Qualified, says. “Freddie Mac Home Possible offers more options to fit a variety of borrower situations” explains Jared Maxwell, vice president of Consumer-Direct Lending for Embrace Home Loans. As with any mortgage program, there are always a few drawbacks.

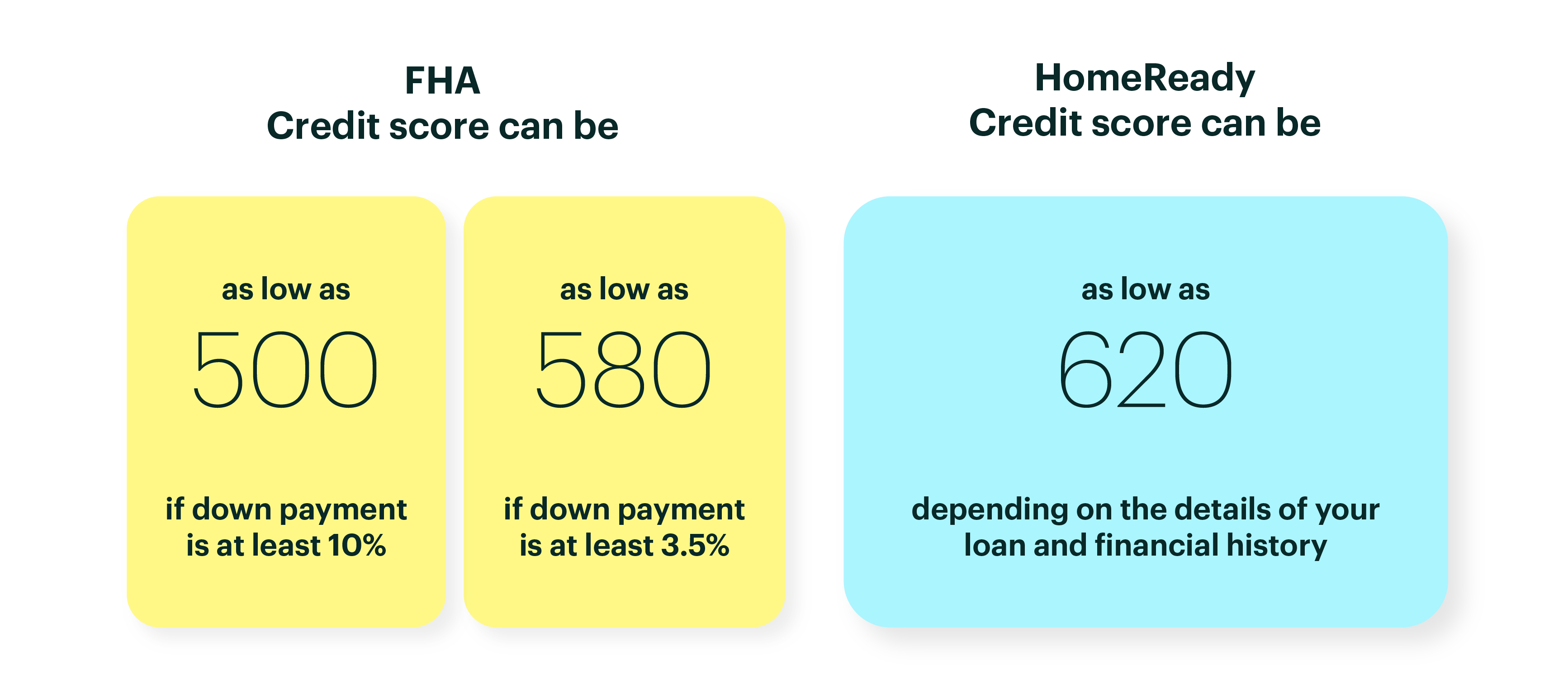

Outside of those basic criteria, income requirements for a home loan are flexible. Most types of income can qualify — from standard salaries to commission, investment, self-employment, bonus, and RSU income. Home buyers at any income level can apply for a mortgage. The most important thing isn’t how much money you earn, but rather, that your income meets a few key requirements. If you purchase one of the types of homes from above, you only need a 3% down payment and you can have a credit score as low as 620 in many cases.

Eligible Income Sources For A Freddie Mac Home Possible Loan

The DTI limit is set at 41%, with exceptions up to 44% with a 680 credit score, cash reserves and job stability for the past two years. No mortgage insurance is required on VA loans, regardless of your down payment. Instead, you’ll pay a VA funding fee between 1.40% and 3.60% depending on your down payment and whether you’ve used your home loan benefits before. Unlike conventional loan guidelines, FHA rules allow you to use money from an FHA cash-out refinance toward required reserves. Borrowers without a credit score may qualify for a Home Possible mortgage if the loan-to-value ratio on the property does not exceed 95%.

Get started on your free pre-approval today to find out why so many homebuyers trust us as their lender for life. HomeReady and Home Possible provide assistance to qualifying low- and middle-income homebuyers with limited ability to make a down payment. So you need to have a steady cash flow and the ability to keep making loan payments over that time. To be eligible for Home Possible lending, your total debts, in addition to your new mortgage payment, cannot eat up more than 45% of your monthly income.

Low Monthly PMI Cost

Household income for eligible buyers may not exceed eighty percent of the area median income, which mortgage applicants can verify at the Freddie Mac website. The requirements for qualifying for each program are also different. This includes factors like credit score, income, and debt-to-income ratio. Some borrowers may find it easier to qualify for one over the other.

It offers low down payments, low fees, and low mortgage insurance requirements. It’s not available for vacation homes or investment properties. The good news is that you can purchase up to 4 units, so you can live in one and rent out the others.

Freddie Mac Home Possible is a conventional loan designed to help low- to moderate-income borrowers buy a home with 3% down. Down payment and closing cost assistance programs can also help lower the upfront costs of buying a home. These programs vary by location, so check with your state housing agency to see what you might be eligible for.

Contact us to find out what loan options are available to you. Several nonprofits and government loans recognize the three-year rule for defining a first-time homeowner. This rule enables people who previously owned a home but were hit with hard times, such as foreclosure, short sale, or bankruptcy, can get a second chance.

Please contact your tax adviser for any tax related questions. Home Possible loans are an excellent way to get a foothold in the world of real estate, as long as you can qualify. The income limits on these loans, however, might negate some of the advantages that come with this agreement. Unlike some mortgage product options, Home Possible loans allow you to apply with a non-occupant cosigner.

That’s why it’s essential to talk to your mortgage lender about which loan programs might be best for you. If you’re a first-time home buyer, there are several types of loans you can apply for when purchasing a home. Many of these loans are gratefully more forgiving on their eligibility to help first-time borrowers. Now let’s say you have other debt — maybe a car payment, a student loan, and credit card payments. Your lender might say you can only afford to spend up to 25% of your gross monthly income on housing expenses. Most home loan programs require two years of consecutive employment or consistent income, either with the same employer or within the same field.

We have unlimited flexibility to shop the entire lender market. This can provide significant pricing advantages over banks. In addition, Mortgage Correspondents are authorized to fund mortgages on their warehouse lines. They use their own funds, or funds borrowed from a warehouse lender to fund their loans. These in-house capabilities virtually guarantee quick and accurate closings for our customers.

The main role of both Fannie Mae and Freddie Mac is to promote an active market for real estate. They do this by buying mortgage loans from lenders and selling them to investors on a secondary mortgage market. This provides lenders with cash so that they can lend more money to home buyers. Their roles have expanded over the years to include homebuying assistance. So it is imperative to monitor and manage your credit score. Pay bills on time and be responsible with your credit.

As a self-employed borrower, be mindful that too many business deductions on your tax return can reduce your qualifying amount. Lenders use your net income after deductions for qualifying purposes. They can add back some deductions, such as those for mileage and use of a home office. As a rule of thumb, the more business deductions you have, the less you earn on paper. In general, you can’t make more than 100% of the average median income for the area. This is the case unless you live in a low-income census tract.

Lower rates now available for HomeReady and Home Possible loans. VA guidelines don’t set a minimum credit score, though 620 is the lowest score many VA-approved lenders will accept. FHA borrowers must pay two types of FHA mortgage insurance. The first is an upfront mortgage insurance premium of 1.75% of the loan amount, typically financed into the mortgage.

No comments:

Post a Comment